The comprehensive CMO’s guide to brand research

What you need to know about brand research, and how it can help you solidify your brand positioning.

In crowded markets, differentiating from the competition is key as it’s the only way to continuously attract new customers and achieve sustainable growth.

Yet many B2B companies struggle with differentiating their brand in the first place. This is mainly due to a phenomenon called strategic herding, where established norms limit differentiation and innovation within the industry.

So how can CMOs make their brands stand out and become a magnet for more leads and prospects?

Part of the answer lies in brand research. This article will explore what you need to know, including ways to use brand research to develop or redefine your brand positioning strategy.

What is brand research?

Brand research is a strategic process aimed at understanding and enhancing your brand’s position in the marketplace. It involves systematically collecting data about your brand and how it is perceived by stakeholders, including customers, employees, and the general public. Key areas of focus include measuring brand reputation, visibility, and equity.

By analyzing and acting on the insights gained from this process, you can strengthen your brand positioning.

What is the ultimate goal of brand research?

When it comes to brand positioning, information is everything.

In an ideal world, marketers would be able to easily understand people’s thoughts, feelings, beliefs, and attitudes toward different brands. But since they only exist in buyers’ minds, it’s our responsibility to find out and ask.

That’s where brand research comes in. Its true goal is to help you understand your brand’s overall role in the marketplace, with the help of formal data collection and analysis.

When performed correctly, it can help you uncover your most valuable differentiators (at least in the eyes of prospective buyers, customers, and clients). You’ll be able to use them to formulate a powerful and accurate messaging strategy, which can then help you establish a brand position that gives you a competitive advantage.

When is the right time to conduct brand research?

All companies undergo significant business-defining changes at some point or another.

When this happens, you must adjust your organization’s brand positioning so that it’s in line with these changes. This should almost always be informed by some form of brand research.

New startup companies that haven’t yet launched a product typically conduct brand research alongside market and persona research (since it’s usually more efficient and cost-effective).

Mature organizations, on the other hand, tend to pursue it when:

- Growth has stalled

- Their brand identity has become dated

- Internal stakeholders no longer know how to describe the firm’s positioning

But regardless of company age, certain triggers or events can necessitate brand research, including:

- Mergers or acquisitions

- Changes to brand architecture (e.g., brand extensions)

- Emerging competitive threats

- Significant shifts in target audience demographics or preferences

What are the most common brand research techniques?

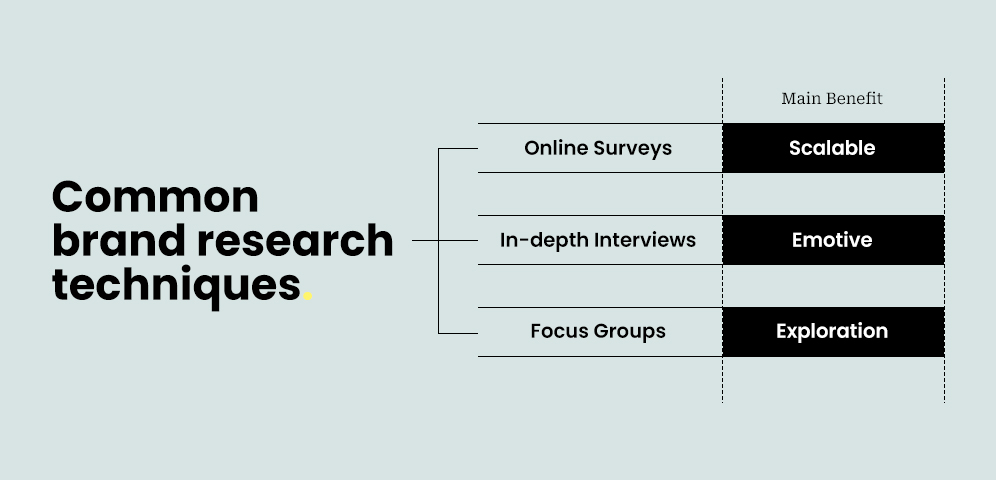

As with any kind of research, there are multiple ways to collect the data you need to develop (or redevelop) your company’s brand positioning.

The more diverse your sources are, the more robust your methodology will be.

Online surveys

Online surveys can be extremely valuable for brand research, regardless of what stage you’re currently at. It’s popular among businesses because they’re scalable (meaning you can distribute them to a large number of people without much effort).

Brand research surveys often exist in the form of Net Promoter Score (NPS) surveys, where you ask respondents how likely they’ll recommend your brand to a colleague on a scale of zero to ten.

NPS is a widely used metric across industries, allowing you to benchmark your performance against competitors. By comparing your NPS with industry standards, you can assess how well your brand is positioned in the marketplace. This comparative analysis can inform strategic decisions about how to differentiate your brand and enhance its appeal.

Customer feedback collected through NPS surveys can also help you highlight the key strengths and weaknesses of your brand. Positive feedback from ‘promoters’ can indicate what sets your brand apart, while criticism from ‘detractors’ can reveal pain points that need addressing. This comprehensive view helps you fine-tune your brand messaging and positioning to emphasize strengths and mitigate weaknesses.

Can I create my own surveys instead?

You can, but keep the following points in mind.

Follow a structured approach

Since most online surveys aim to gather quantitative data, it’s crucial to adopt a structured approach. Start by setting clear hypotheses about your brand. Your survey questions should be designed to test these hypotheses, allowing you to prove or disprove them with data.

Ensure clarity and objectivity

Your survey questions must be free from leading or confusing language. The former can lead to skewed and biased responses; the latter can reduce the reliability and validity of your results. Carefully review your questions and consider how they might be interpreted by respondents.

Run a pilot test

Before launching your survey, run a pilot test. This helps identify issues with language, survey length, or technical glitches. Feedback from the pilot test can be used to make necessary adjustments, ensuring your survey is effective and user-friendly.

In-depth interviews

An in-depth interview is a research method that involves asking relevant participants questions using a predefined framework, meaning you have already decided on the topics and subtopics you’ll explore. These interviews can be conducted either online or face-to-face.

There are two useful types of in-depth interviews: structured and semi-structured. Unlike structured interviews, semi-structured interviews do not follow a strict sequence and allow room for additional questions.

Conducted on a one-to-one basis, these interviews enable you to easily observe participants’ paralanguage (e.g., facial expressions and nuances in their voices). This is especially valuable if you’re trying to understand how people currently feel about your brand.

Some key questions you could ask include:

- How would you describe your latest interaction with our brand?

- If we came to you and said we made a bunch of changes to our brand, what would you hope to hear? What would you hope not to hear?

Focus groups

Compared to surveys, focus groups are a much less scalable method of brand research – so obtaining large amounts of standardized data shouldn’t be the goal here.

However, the benefit of focus groups is the sheer breadth and richness of qualitative information you can collect, which is ideal for exploratory brand research. For instance, you may be developing a new brand and entering an unfamiliar market at the same time.

There are a few things to keep in mind when hosting a focus group. First, select a moderator who is not only knowledgeable about the industry but also flexible enough to manage group dynamics. This ensures you get the most out of each participant.

Second, carefully consider your sampling strategy. Focus groups should be fairly homogeneous. Participants should share a few common characteristics (such as their occupation) to ensure everyone is comfortable enough to speak openly and freely.

And when it comes to determining the ideal number of focus group sessions, there’s no hard and fast rule. One session is rarely sufficient, but anything more than several will probably yield diminishing returns. This is because your research will likely reach ‘saturation’, meaning you’re unlikely to discover anything new or meaningful by hosting additional sessions.

How can companies use brand research to strengthen their brand positioning?

Brand research can help you develop three main internal documents, each of which is key to a successful brand positioning strategy.

A list of brand differentiators

Having a simple list of brand differentiators can align your internal stakeholders’ understanding of what exactly sets your organization apart from competitors. They can also help you craft an effective positioning statement.

If you already have a list, brand research can help you confirm whether your external stakeholders (i.e. your customers) perceive your claims to be true. What you uncover during this process may be surprising!

If your objective is to discover your organization’s points of differentiation, you could ask questions like:

- What word comes to mind when you hear our brand name?

- Why do you choose our brand over others?

- What does our brand offer that competitors don’t offer?

Keep in mind that a differentiator is only a differentiator if it meets all of the following criteria:

- It must be true

- It must be important to your target persona

- It must be provable (otherwise, this can lead to ‘doubtful’ brand positioning)

Most B2B brands differentiate by specializing within an industry, offering a unique technology or process, having a specific geographical focus, or honing in on a particular target audience. But you can also find brands that emphasize their unique business models or exceptional customer service.

Perceptual maps

Perceptual mapping is a technique you can use to understand where brands

in a relevant category ‘fit’ in the minds of target buyers and customers. Understanding this is important because the way prospects position your brand has an effect on their long-term purchasing decisions.

Generally, perceptual maps are represented as two-dimensional plot graphs with four quadrants and two axes. The axes should be labeled according to what is most relevant for your customers.

For instance, a tech brand may choose to create a map based on ‘features’ and ‘price’ (as they’re two attributes that have a large influence on their purchasing decisions).

If you believe there are more than two important brand attributes, you can indeed create more sophisticated variations (or multiple perceptual maps).

Questions that can help you accurately draw a perceptual map include:

- Who are our brand’s true competitors?

- What are your key priorities?

- Rank this brand in order of preference from a list of competitor brands based on X, Y Z

It’s worth noting that if you find your brand to be in the middle of every perceptual map you draw, there’s likely a problem. That means the people you collected data from (whether it’s customers or otherwise) don’t have a clear understanding of what makes you stand out. This is a phenomenon known as ‘under-positioning’, which often leads to inconsistent sales. To overcome this, you may need to audit your brand positioning and find ways to communicate your unique selling point (USP) more clearly.

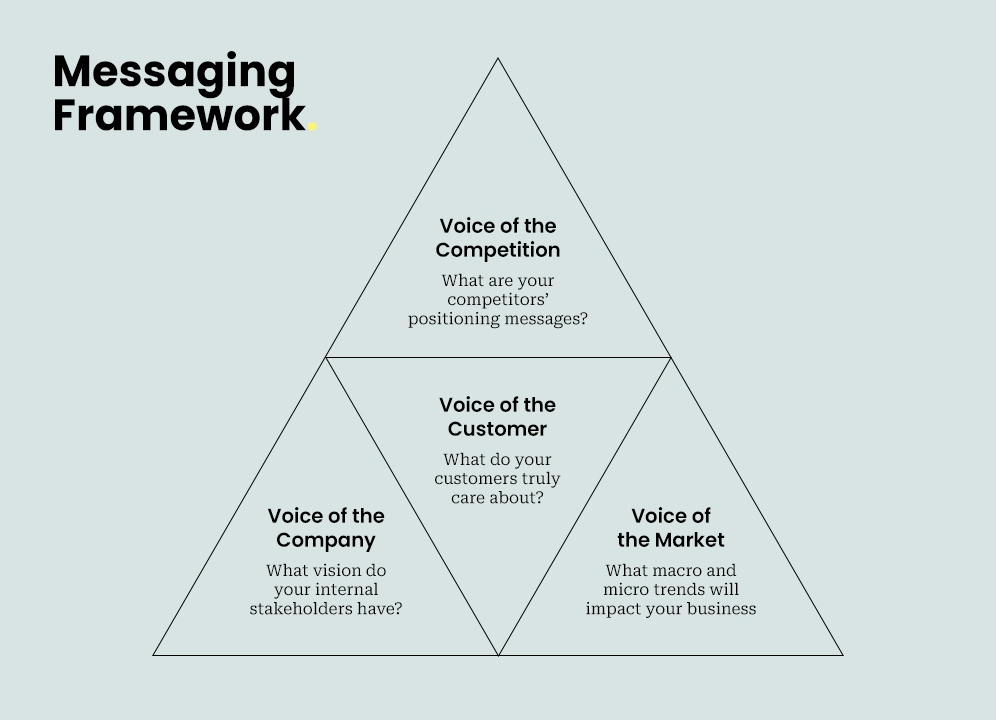

Messaging framework

A messaging framework is a strategic document that identifies your tone of voice, your primary personas and what sort of messaging is appropriate for each. This will help your organization standardize your communications to all of your customers.

To successfully develop this framework, you’ll need to draw on four types of insights:

- Voice of the competition: what are your competitors’ positioning messages?

- Voice of the customer: what do your customers truly care about?

- Voice of the company: what vision do your internal stakeholders have?

- Voice of the market: what macro and micro trends will impact your business?

Messaging frameworks tend to include a strapline, an elevator pitch, key value propositions, tone of voice guidelines, and separate messaging sections for different personas. Within each section, you’ll need to identify a core need for that particular persona, outline key challenges and objections, and include how your brand solves those problems (with proof points).

To help you accomplish these goals, you may ask your stakeholders questions like:

- What do you value most?

- What are your biggest challenges?

- How do you think our firm delivers on our promises?

Final thoughts

Brand research is one of the most fundamental components of brand positioning. Without it, decisions about your organization’s messaging will be based on guesswork and personal assumptions.

By selecting the right research methods and techniques for your company, you can collect the data you need to develop your brand strategy and boost your competitive advantage with differentiated messaging.

This post has been updated on June 24th, 2024. Originally published: July 26th, 2022

Read the latest positioning trends and insights.

Tap into our brand and product positioning, storytelling, and creative expertise to inspire your next strategic move.