How to craft successful go-to-market (GTM) strategies for startups

What’s the right go-to-market (GTM) approach for a startup and how do you go about creating one? This article shares what you need to know.

If you follow entrepreneurial news, you might’ve already heard that 90% of startups fail. But why?

Some of the reasons for this are straightforward—like a lack of funding or market research. Others are less obvious, like having a GTM strategy that’s not appropriate for a startup.

When looking out for real-life examples of go-to-market strategies, you may find it tempting to mimic what successful established companies are currently doing. However, this is a mistake, as startups and mature companies have very different goals and priorities.

This article provides an overview of what GTM strategies are and what’s included in them.

What is a go-to-market (GTM) strategy?

A go-to-market (GTM) strategy is a step-by-step tactical plan to effectively and efficiently enter a market—whether it’s by introducing a new product to an existing market or vice versa. It provides a clear roadmap for growth.

Why do startup companies need go-to-market (GTM) strategies?

There are a few key reasons why startups specifically need to have a GTM strategy in place.

Bringing a product to market carries significant risk. Without thorough planning and research, your strategic decisions will be less informed and your product launch will have slimmer chances of long-term success. Having a well-developed GTM strategy can greatly increase these odds.

Another important reason has to do with increasing investors’ confidence. If your startup will be seeking seed funding, having a documented plan can help your organisation secure and attract investors down the line.

Why (and how) should startups approach GTM plans differently?

It would be a misstep to simply copy the GTM strategy of an established player in the market. Why? Put simply, because the rules are different.

Mature companies are more likely to have more resources and capital at their expense. Startups, however, need to take these practical constraints even more seriously. For this reason, a key objective of your GTM strategy should be to put your product in front of as many relevant customers as possible for the least amount of money.

Another thing you should consider is product-market fit. Acquiring new customers is much more expensive and time-consuming when you’re a startup. Therefore, you should make sure that there’s a real market need for your product; otherwise, you’ll find it hard to lower your customer acquisition cost (CAC).

How to create a go-to-market strategy for startups in 8 steps

1. Analyse your external and internal environment

Before you start, it’s important to understand the current state of your company, your competitors, and your market. Not doing so increases the risk of developing a GTM strategy that’s too generic to be effective.

Analyse your market

It’s very important to assess whether there’s actually a market need for your product. What problems does it solve (and what evidence do you have)?

Once you’ve validated your product, you can then begin desktop research on market trends (data platforms like Kantar or Mintel will help). Use your findings to uncover factors that may impact your organisation’s ability to deliver value.

These trends could be:

- Political/legal: You might look into how trade restrictions, data privacy laws, and pricing regulations are changing.

- Economic: Factors like inflation rates, credit availability, and disposable income can impact your success in the market.

- Sociocultural: Examine how media consumption habits are evolving. If your ideal customer is gravitating towards a new social media channel, for instance, this might be opportunity to seize later on.

- Technological: New technologies emerge constantly—what’s the rate of adoption in your market?

Analyse your competitors

In order to successfully enter a market, you must find a gap and fill it.

This can only happen if you analyse your would-be competitors first. This includes your:

- Direct competitors: any company that sells a similar offering as you.

- Indirect competitors: any company that sells a product or service in the same category as you (but it’s different enough to act as a substitute).

- Replacement competitors: any company that offers an alternative to the type of products or services you offer.

Once you’ve decided who you’re going to benchmark against, it’s time to start your data gathering process. Using a wide variety of sources (e.g. direct interviews with defected customers, company reports, websites, press releases), find out all you can about your competitors’:

- Current and future strategic objectives:

- What are they trying to achieve and how? Are they trying to grow by simply by promoting their existing products, or by divesting into a new market completely?

- Messaging, solutions, and propositions:

- How would you describe the way they communicate to their customers?

- Who do they help and how do their products solve their needs?

- How unique is their messaging?

- Resources, assets, and capabilities:

- How many patents and copyrights do they have?

- Have they received any funding?

- What type of skills do their employees have?

- What strategic decisions have their senior managers made in the past?

- Marketing activities:

- What channels do they use?

- How well do they perform overall?

- What types of content and topics perform best?

Finding the answers to these questions will help you draw inferences about their overall positioning within the market, which will come in handy when you’re trying to position your own product.

Find out how you can conduct an in-depth competitive analysis here.

Analyse your company

After examining the competitive landscape, look inward and analyse your organisation.

This is important because organisational constraints play a role in your GTM outcome.

Take a close look at your company’s resources, capabilities, and goals. How will your product launch align with everyone’s broader strategic objectives? Make sure to speak to a variety of internal stakeholders and ask them what their aspirations are.

You can use the SWOT (strengths, weaknesses, opportunities and threats) framework as a way to gain a holistic view of your organisation.

2. Define your target market and buyer personas

Not every customer is an ideal customer. Your product can only solve so many needs, so it’s important to select the right market segment (or segments) for your offering. This will allow you to dedicate your time, energy, and resources to people who are most likely to become loyal customers.

How to define the ideal target market

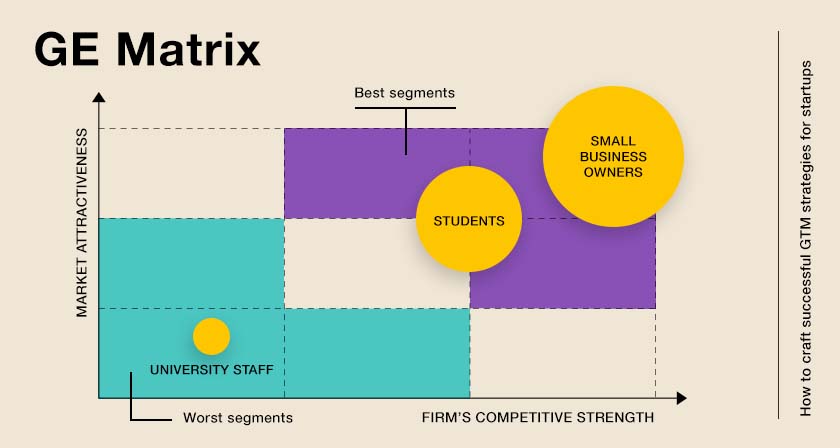

Market attractiveness is about how strategically and financially valuable it is to serve a specific segment. Typically, this will depend on factors such as market size, growth rates and price sensitivity. Large, fast-growing and price-insensitive segments are generally considered to be ideal.

Competitive strength refers to your ability to secure and maintain market share in a segment (relative to your competitors). If you’ve identified an extremely large segment but don’t have enough organisational resources to meet their needs, then it’s not right for your company.

If you’d like to gain a clear visual understanding of all potential segments, you can create a GE matrix.

See above for an example. The size of each bubble denotes the size of the market segment. Small business owners represent the best segment for this specific firm (followed closely by university staff), whereas IT managers represent the worst.

How to build your buyer personas

Once you’ve chosen your ideal target market, zoom in closer and start building your personas.

Personas are fictional profiles based on real data. They help you differentiate between different types of people within your target market, so you can tailor your messaging in a more personalised way.

This is especially important in a B2B context. According to Gartner, six to ten people are involved in every B2B purchase. These people make up what’s called the ‘buying centre’.

Each buyer plays a key role in the purchase (though some of them may occupy more than one role):

- Initiator: Starts the buying process

- User: Uses your product regularly

- Influencer: Persuades others that the product is needed

- Decision maker: Gives final approval for the purchase

- Buyer: Owns the budget

- Approver: Final approver who pushes the initiative on a larger scale

- Gatekeeper: Stops your product from being approved

In order to convince these people to buy your product, you need to understand their distinct motives, goals, problems, and pain points. This means you’ll need to conduct personal semi-structured interviews with them.

A semi-structured interview is an interview method that involves asking participants a set of pre-determined questions—while allowing for some flexibility and spontaneity at the same time.

Create a research brief

Start by creating a research brief. Write down your research objectives and think about you’re specifically trying to achieve. Usually, you’ll want to discover what your target customers’ goals and challenges are, but you can add other goals too.

You should also think about how many participants you plan to interview, and for how long.

There are no hard and fast rules for this. But you should generally interview participants until you feel you won’t get any more meaningful data by hosting more sessions. Also, the shorter your sessions are, the more

Develop your interview questions

Your research brief should inform how you develop your questions. The way you phrase them is very important; misleading, irrelevant, or poorly-worded questions can hinder the value of your results.

Questions you could ask include (but are not limited to):

- What’s your job title?

- What are your core responsibilities? How is your success measured?

- What are the biggest challenges in your role?

- What products do you use to help you overcome these challenges? What would streamline your processes?

- How do you learn about new products, trends, or services? What are your trusted sources?

Recruit interviewees

How do you convince people to be your interviewees?

When you reach out to them (whether it’s via LinkedIn, email or online forums), the key is to clearly communicate your intentions and highlight why they would want to participate in your research.

draft a concise letter template outlining the following:

- Who you are

- Why you’re contacting them

- The duration of the interview

- Interview dates

- What they’ll receive in exchange for their time

The most effective way to incentivise responses is to offer cash vouchers. If this sounds like a feasible option for your company, be sure to calculate a budget first.

Analyse your interviews

Once you’ve completed your interviews, the next step is to review and analyse your findings. By now, you should already have complete transcripts of your conversations with each of your participants.

Before you analyse the transcripts, you must read each one carefully. Only then should you start annotating and labelling relevant keywords and phrases that may help you draw conclusions about your research. These keywords and phrases are known as ‘codes’.

Afterwards, you’ll begin to see thematic patterns and links within and between various groups of code. This will let you form accurate hypotheses about your personas.

Pull together a report

Reports (whether they’re presented as presentations or playbooks) help you consolidate all the insights you gained from this process. They also serve as a point of reference for your internal stakeholders.

Make sure to provide context to your findings. Include details about your personas (such as their job roles, goals, and challenges) and provide a few quotations from your transcripts to support your hypotheses.

3. Define your brand positioning and messaging

Use all the data you gathered so far to shape how you want people to perceive your brand. Ask yourself: how do you plan to stand out?

The most practical way to get started is to create two internal assets: a perceptual map and a messaging matrix.

Perceptual map

Perceptual mapping is a technique marketers use to better understand how brands in a relevant category ‘fit’ in the minds of target customers. It helps you visualise market gaps easier, so you can find opportunities for differentiated branding.

Generally, perceptual maps are represented as plot graphs with four quadrants (but you are free to make other variations). How the y and x axes should be labelled depends on what your customers care most about. For software products, for instance, it might be price and features.

Begin by placing your competitors’ brands somewhere on the map; use your interview data to guide you. Then you can add your own brand.

If you have a differentiated offering, you’ll find it relatively easy to find a distinct position on the map. But if you struggle to do so, it might be a sign you need to re-evaluate your core offering.

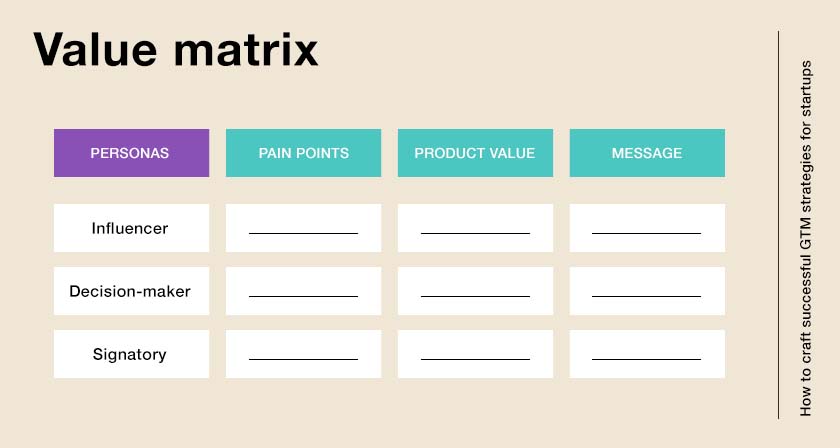

Value matrix

A value matrix is an internal document all teams in your organisation should use. It helps you create and consolidate all your key messages, which will serve as the basis for all your customer-facing assets (e.g. your website, social media posts, newsletters).

Create a table with rows for all your personas. Then, outline all the business problems that each persona faces on a daily basis. If your product can solve or ease any of these problems, write them down.

Not only will this help you craft personalised key messages for each persona, but it’ll also help create a unique value proposition (UVP)—a statement that clearly expresses your product’s distinct selling points.

If you’re not sure if your messaging is effective, you can test it on a small scale.

Start advertising on social media and/or Google Ads using the key points you’ve just created. After a few weeks or more, you’ll be able to assess what type of messages produce the best results (i.e. high ROI and high conversion rates).

Continue to optimise further and make sure to use your learned insights to inform your formal paid campaigns.

4. Formulate your content strategy

Now’s the time to develop content that will attract, persuade, and delight customers.

At this point, you should have a good understanding of the type of content that your target market engages with most.

It’s important that you develop assets for every stage of the buyer’s journey, so you can acquire leads and move them along the conversion funnel.

There are six main stages in a typical buyer’s journey:

- Awareness: The prospect becomes aware of your brand. You can encourage this by developing and promoting informative content such as blog posts, eGuides, infographics, and more.

- Consideration: The prospect compares your solution against others. Landing pages and case studies are good examples of middle-of-the-funnel assets.

- Decision: The prospect is ready to convert and make a purchase. They may rely on product videos, reviews, and demos.

- Onboarding: Now the prospect is a customer. One popular way to initiate your first customer interaction is via email.

- Retention: Content that provides value to existing customers perform best at this stage. Social media is a good way to keep your brand top of mind.

- Advocacy: To make customers promote your brand on your behalf, you need to encourage user-generated content (i.e. videos, reviews, etc.).

The main goal here is to make your prospects’ interactions with your organisation as seamless as possible.

To make this happen, you must design the right conversion paths for every relevant persona. This means conducting keyword research using tools like Google Keyword Planner, developing context-dependent landing pages, and crafting tailored CTAs.

For example, you should always align the message in your Google Ads copy with the landing page you’re linking to, so you can maximise the chances of conversion.

6. Develop your sales enablement strategy

Sales enablement is all about building your company’s internal capability, so your salespeople can effectively and efficiently push your product to market.

To do this, you’ll need to empower them with the right content.

Review what assets are currently being used by your organisation; this audit should help you identify any potential content gaps. After all, it’s usually best to have a wide variety of sales assets. This includes:

- Positioning guides/brochures: a customer-facing, long-form asset that establishes and positions your company in the market.

- Competitive battlecard: an internal document that helps your salespeople understand points of parity and difference between your brand and your competitors.

- Case studies: an article or eGuide that revolves around your core narrative, with clear proof points.

- Sales deck: a presentation that showcases your brand’s key capabilities and value propositions.

- One-pagers: a one-page document that clearly outlines a specific aspect of your business.

Once you’ve created these assets, be sure to create a centralised knowledge or resource base that can be accessed by all internal stakeholders. This way, salespeople can easily and independently refresh themselves with the relevant knowledge.

If you have a large team, however, they may even benefit from sales training. Just keep in mind that the way you deliver information depends on the sales model your Head of Sales picks, which is likely to be one of the following:

- Self-service model: Customers purchase your product on their own. This is common for B2C products.

- Inside sales model: Your sales team nurtures leads to convince them to purchase your product. This is a good option for high-involvement products, like B2B software.

- Field sales model: Salespeople focus on closing expensive enterprise deals. This option requires more investment and is suitable for longer sales cycles.

- Channel model: An external partner sells your product for you.

7. Confirm your pricing model

Pricing isn’t just a financial decision; it affects all areas of your business. Getting it right is not only key to your product launch’s success, but also to your company’s overall long-term health.

If you set your prices too high, you’ll struggle to sell. But if it’s too low, you won’t be able to cover your costs. To find the right balance, consider the following factors:

- Your fixed and variable business costs

- The spending power of your target customers (or their businesses)

- Critical short-term costs you need to cover (e.g. loan repayments)

- How your competitors price their products

You can validate this further through additional market research. Many firms use the Van Westerndorp index when sending pricing surveys to their potential customers. The index is a set of four questions that help you narrow down your options:

- At what price do you think the product is priced so low that it makes you question its quality?

- At what price do you think the product is a bargain?

- At what price do you think the product begins to seem expensive?

- At what price do you think the product is too expensive?

Once you have your data, you can plot the answers to each question on a graph. The place where the ‘too cheap’ and ‘too expensive’ graph lines intersect is where you’ll find the optimum price point (OPP) for your product.

Another thing to consider is how you’re going to actually present your prices to your customers. If you’re targeting different personas with wildly different needs, a tiered pricing model may be the ideal choice. But if you have an online product (like software), you might choose to adopt a free trial model instead.

No matter which pricing model you choose, always make sure that your customer lifetime value (CLV) stays higher than your customer acquisition cost (CAC).

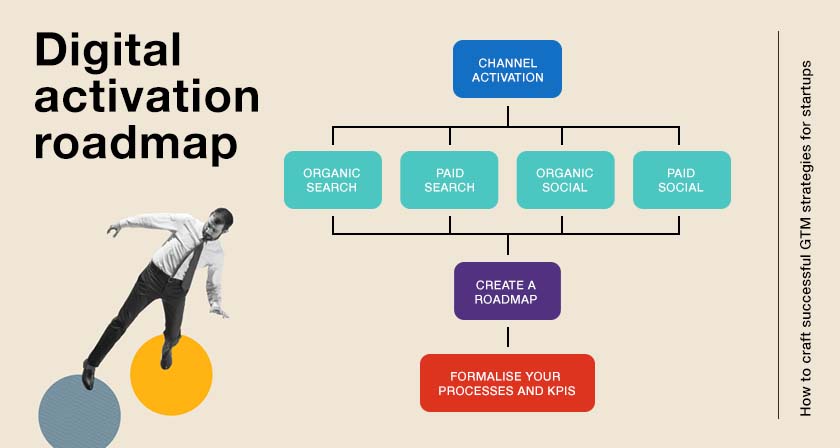

8. Establish your digital activation roadmap

The final step is to put together a media plan and prepare for launch.

Channel activation

By this point, you will already have developed a content strategy. But how are you going to promote your content?

This is where activation comes in. If you’re still not sure which to pick, use findings from your competitive analysis to give you an idea of what other organisations are doing. There are many channel opportunities and tactics you can incorporate into your overall GTM launch. This includes:

Organic search

Blog articles and landing pages (as well as other earned media assets) should be promoted through search engine optimisation (SEO), so prospects can find out about your product. You can also publish article on selected third-party media websites to create backlinks and boost brand awareness.

Paid search

Paid search helps people find your brand for terms that aren’t ranking organically. What’s more, display ads and promotional banners are especially well-suited for brand awareness and remarketing. To get started, perform keyword research using Google Keyword Planner and save the best keywords into a list. Aim for ones with high search volumes, low competition, and low cost-per-click.

Organic social

Social media platforms such as LinkedIn and Twitter are especially popular for B2B organisations. And because it’s free to use these platforms, promoting your content via these channels is a must. Use Ritetag to help you identify the most relevant hashtags for your product.

Paid social

Paid social allows you to target specific personas (for example, on LinkedIn, you can launch ads that only people with certain job titles can see). This is especially useful for startups that are new to a specific B2B industry.

Create a roadmap

To properly organise your ideas on what types of content to develop and what promotional channels to use, we recommend creating a customer journey roadmap.

This will let you visualise all the potential touchpoints your personas may experience—and anticipate the roadblocks they may encounter before moving on to the next stage. Include how your company will lift these roadblocks, and assign who exactly will be responsible for each task (for example, will it be a sales rep or a customer service agent?).

Formalise your processes and KPIs

When you activate channels, you also need to establish your workflows and metrics.

What’s more, the success of your go-to-market strategy heavily depends on the goals you set, so it’s important to establish measurable and realistic KPIs for your marketing team.

Ask yourself if the metrics align with corporate or commercial goals (e.g. are you trying to secure more funding?). If you’re not sure, use what you learned from your internal company analysis to guide your decision-making.

Set up your CRM and marketing analytics tools (e.g. Hubspot, Google Analytics) and have your dashboards ready. Try to stay avoid vanity metrics, like social media impressions or number of website views. Some of the metrics you may want to measure include:

- Leads generated

- Revenue

- Competitive win rate

- Number of product trials

- Customer acquisition and conversion rate

- Product adoption and retention rate

- Feature usage (% of unique feature users, avg. number of users/day, etc.)

- Customer support tickets

- Social media engagement rates

As your GTM strategy becomes reality, you’ll need to stay flexible and be willing to make changes whenever necessary. Continue collaborating with other departments and share your updates using a centralised project management tool.

Conclusion

Go-to-market strategies are vital for startup companies because they help you scale faster and stand out to customers—even when you’re up against established players in the market. By keeping product-market fit and relevant data (from your company, your customers, and your competitors) in mind, you can effectively complete all the steps—whether you’re building target personas or formulating your marketing strategy.

Still, keep in mind—having a GTM strategy is only the beginning. Your organisation still has to manage customer reactions to your product and prepare for your competitors’ reactions to you entering the market. That’s where your post-product-launch strategy comes in.

Read the latest positioning trends and insights.

Tap into our brand and product positioning, storytelling, and creative expertise to inspire your next strategic move.